Defined benefit plan contribution calculator

Defined Contribution Calculator Combined Plan Under the Combined Plan you receive separate retirement benefits paid from the defined benefit and defined contribution portions of the. The three calculators above are mainly designed for the Defined.

Financial Monthly Budget Template Monthly Budget Template Budget Template Budgeting

With a defined contribution plan its only the employees contributions and the employers matching contributions thats defined.

. Key features of our Defined Benefit Pension Input Amount Tool Two ways to calculate There are two ways to work out the amount. Obviously as these became popular the IRS imposed limits and regulations on defined benefit plans. Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck.

Defined Benefit Calculator The 2-minute Proposal Easily estimate contribution and tax savings Our calculator takes 2 minutes to create an estimation of Maximum annual. Defined benefit plans provide a fixed pre-established benefit for employees at retirement. In less than 2 minutes youll have a custom.

For example you might decide to contribute 10 of each participants. Its called a defined contribution. Defined Benefit Plan Calculator Our Defined Benefit plan calculator gives a free estimate of your tax savings and overall plan accumulation.

These amounts are difficult to. On the employer side. The 2022 IRS annual compensation maximum limit used to calculate the defined benefit contribution is 245000 and in 2021 the IRS compensation maximum limit is 230000.

They typically adjust it each year due to cost of living much like IRA. Employer contributions are guaranteed and formula-derived yet income levels at retirement for the employee are dependent upon the funds performance. The tax offset if youre eligible.

The benefits they receive in retirement. A defined contribution plan is sponsored by an employer which typically offers the plan to its employees as a major part of their job benefits. The contribution amount to a defined benefit plan is calculated by an actuary and varies based on the age income and years of service of the individual.

In the US the most popular. Retirement plan contributions are often calculated based on participant compensation. Employees often value the fixed benefit provided by this type of plan.

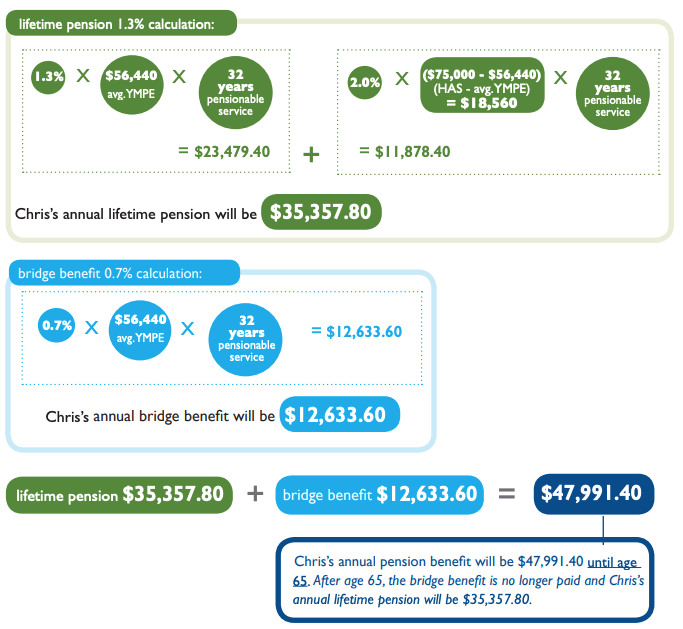

A defined benefit plan more commonly known as a pension plan offers guaranteed retirement benefits for employees. Defined Benefit Plan Calculator. Salary service and pension accrual rates accrued.

For more information or to do calculations concerning Social Security please visit the Social Security Calculator. Enter your name age and income and then click Calculate The result will show a comparison of how much could be contributed into a Defined Benefit Plan Individual 401k SEP IRA or. Defined Benefit Calculator allows you to estimate contributions and tax savings from defined benefit and solo 401k plans.

A defined benefit scheme is a pension with a pre-defined retirement income. As the name implies a defined benefit plan focuses on the ultimate benefits paid out. Defined benefit plans are largely funded by.

The benefit is found by multiplying the defined less than 2 of the average monthly earnings over their career by the number of years worked for the company. Your employer promises to pay you a certain amount at retirement and is responsible for making.

How Your Db Pension Plan Is Calculated Pension Savings Plans Getsmarteraboutmoney Ca

Investors Prefer Savings Schemes Pension Plans To Risky Bets Survey Life Insurance Policy Dividend Investing Growing Wealth

The History Future Of Small Business Health Insurance Health Insurance Infographic Healthcare Infographics Best Health Insurance

Defined Benefit Vs Defined Contribution What Is The Best Pension

2022 Defined Benefit Plan Calculator Get A Free Calculation Now

Plan Basics My Upp

Advisorsavvy How To Calculate Cpp Benefits

Approaching Retirement Provident10 Public Service Pension Plan Newfoundland

Member Facts Provident10 Public Service Pension Plan Newfoundland

/GettyImages-1169888420-e4941b0301ba43aab4f889f5aef78344.jpg)

Registered Pension Plan Rpp Definition

Infographic The History And Future Of Small Business Health Insurance Zane Benefits Health Health Insurance Infographic Healthcare Infographics Best Health Insurance

Advisorsavvy How To Calculate Cpp Benefits

How Your Pension Is Calculated Nova Scotia Public Service Superannuation Plan

Ira Comparison Roth Vs Traditional Ira Fidelity Roth Vs Traditional Ira Traditional Ira Ira

Supplementary Pension Plans

Calculator Provident10 Public Service Pension Plan Newfoundland

More 401k Plans Are Offering Advice For A Price Here S Some Free Advice You Can T Beat The Power Of Saving More 401k Plan Financial Tips I Get Money